In today’s fast-paced world, getting access to credit is often necessary — whether it’s for buying a car, funding higher education, purchasing a home, or even managing emergency expenses. Fortunately, the United States offers a wide range of loan options with competitive interest rates and flexible repayment terms. But the key to securing the best deal lies in knowing how the loan process works and choosing the right financial institution.

In this comprehensive guide, we’ll explain:

- How to get a loan in the USA (step-by-step)

- The types of loans available

- Eligibility criteria

- Required documents

- And a detailed list of 7 well-known banks in the USA that provide loans, along with their loan offerings and features.

Part 1: Understanding Loans in the USA

🧠 What is a Loan?

A loan is a sum of money borrowed from a lender (like a bank or credit union) that you must repay over time with interest. Loans are categorized by purpose — such as personal, home, auto, student, or business loans.

Part 2: Types of Loans Available in the USA

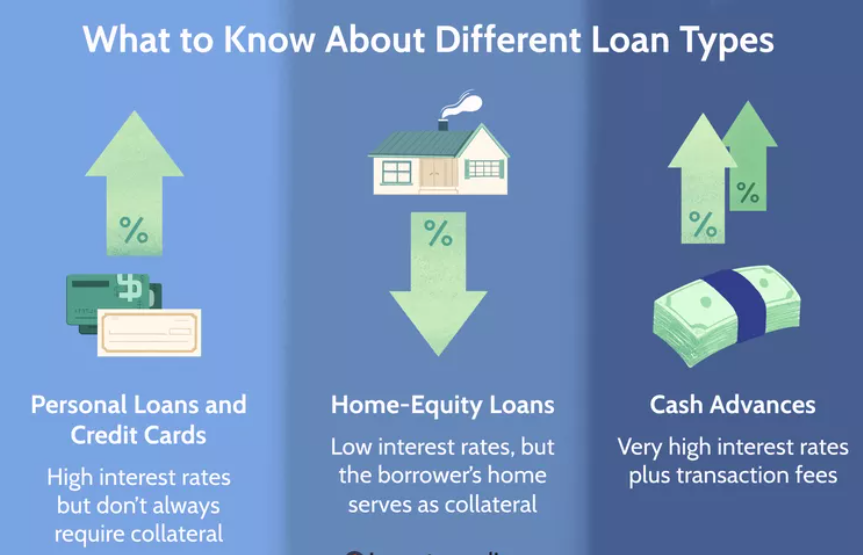

1️⃣ Personal Loans

- Unsecured (no collateral required).

- Used for medical bills, weddings, vacations, debt consolidation.

- Fixed interest rates and repayment terms.

2️⃣ Home Loans (Mortgages)

- Used to purchase real estate.

- Can be conventional, FHA, VA, or USDA loans.

- Usually repaid over 15–30 years.

3️⃣ Auto Loans

- Used to buy a new or used vehicle.

- Lower interest rates compared to personal loans.

- Usually secured by the car itself.

4️⃣ Student Loans

- Federal or private loans to fund education.

- Low interest and flexible repayment.

- Federal loans often offer income-based repayment plans.

5️⃣ Business Loans

- Designed for entrepreneurs and business owners.

- Can be term loans, lines of credit, SBA loans.

- Require business plans and financials.

Part 3: How to Get a Loan in the USA – Step-by-Step Guide

✅ Step 1: Know Your Credit Score

Your credit score (FICO score) determines your loan eligibility, interest rate, and approval chances.

| Score Range | Rating |

|---|---|

| 750+ | Excellent |

| 700–749 | Good |

| 650–699 | Fair |

| 600–649 | Poor |

| Below 600 | Very Poor |

You can check your credit score using:

- Credit Karma

- AnnualCreditReport.com

- Experian, TransUnion, Equifax

✅ Step 2: Decide What Type of Loan You Need

Every loan has different terms, uses, and qualifications. Be clear about:

- How much you need.

- How soon you can repay.

- Whether you want a fixed or variable interest rate.

✅ Step 3: Compare Lenders

Research and compare:

- Interest rates (APR)

- Loan terms

- Fees and charges

- Prepayment options

- Customer service ratings

✅ Step 4: Prepare Documents

Required documents generally include:

- Photo ID (Passport, Driver’s License)

- Social Security Number (SSN)

- Proof of Income (Pay stubs, W-2s, tax returns)

- Employment history

- Bank account statements

- Credit history

✅ Step 5: Apply for the Loan

You can apply:

- Online through bank websites

- In-person at a branch

- Via loan agents or brokers

✅ Step 6: Wait for Approval and Disbursement

Banks may take a few hours to a few days to approve and disburse funds. Ensure you understand:

- Monthly EMIs

- Interest rate terms

- Penalty clauses

Part 4: Top 7 Banks in the USA That Provide Loans (Detailed Information)

🏦 1. Wells Fargo Bank

Loan Types Offered:

- Personal Loans

- Auto Loans

- Home Mortgages

- Student Loans (via partnerships)

Key Features:

- Loan amounts up to $100,000.

- Fixed interest rates.

- No origination fee on personal loans.

- Fast online approval.

- Loans available even for those with fair credit scores.

Website: www.wellsfargo.com

🏦 2. Bank of America

Loan Types Offered:

- Mortgages

- Auto Loans

- Business Loans

- Personal Loans (via partnership)

Key Features:

- Competitive APR on auto loans.

- Custom loan calculators and online prequalification.

- Special offers for existing account holders.

- Extensive branch and ATM network.

Website: www.bankofamerica.com

🏦 3. Chase Bank (JPMorgan Chase)

Loan Types Offered:

- Mortgages

- Auto Loans

- Business Loans

- Credit Cards (alternative to personal loans)

Key Features:

- Wide loan coverage for businesses and homeowners.

- Flexible repayment plans.

- Good customer service and online tools.

- Pre-qualification with no credit impact.

Website: www.chase.com

🏦 4. Citibank

Loan Types Offered:

- Personal Loans

- Mortgages

- Credit Cards

- Small Business Loans

Key Features:

- Personal loans up to $30,000.

- Fast funding within 1–2 business days.

- Custom repayment periods.

- Competitive APR starting around 8%.

Website: www.citi.com

🏦 5. U.S. Bank

Loan Types Offered:

- Personal Loans

- Auto Loans

- Mortgages

- Business Loans

- Home Equity Loans and Lines of Credit (HELOC)

Key Features:

- Loan amounts from $1,000 to $50,000+.

- Fixed and variable rate options.

- Offers quick online application and funding.

- Rate discounts for bank customers.

Website: www.usbank.com

🏦 6. Discover Bank

Loan Types Offered:

- Personal Loans

- Student Loans

- Credit Cards

- Debt Consolidation Loans

Key Features:

- No origination fees or prepayment penalties.

- Personal loans up to $40,000.

- Repayment terms of 3–7 years.

- Dedicated support for students and debt management.

Website: www.discover.com

🏦 7. PNC Bank

Loan Types Offered:

- Personal Loans

- Auto Loans

- Mortgages

- HELOC

- Student Loans

Key Features:

- Personal loans from $1,000 to $35,000.

- Fixed monthly payments.

- Competitive rates with autopay discounts.

- Online loan calculator and mobile banking.

Website: www.pnc.com

Part 5: Tips to Improve Loan Approval Chances

- Maintain a high credit score.

- Pay off existing debts before applying.

- Choose the right type of loan and lender.

- Apply with a co-signer or co-borrower if your credit is low.

- Don’t apply for multiple loans at once — it affects your credit report.

Part 6: Common FAQs About Loans in the USA

Q1: Can I get a loan without a credit history?

Yes, some banks offer loans to individuals with no credit, especially students or new immigrants. You may need a co-signer or proof of income.

Q2: Are online-only lenders safe?

Yes, if they are registered and have good reviews. Always check lender credentials before sharing personal details.

Q3: What is a loan APR?

APR (Annual Percentage Rate) includes both the interest rate and additional fees — it’s the true cost of borrowing.

Q4: Can I pay off my loan early?

Yes, most banks allow early repayment, though some may charge a prepayment penalty. Read the fine print.

Q5: What happens if I miss a payment?

Missing payments can result in penalty fees, credit score drop, or loan default. Always contact your lender to renegotiate terms.

Conclusion

Getting a loan in the USA doesn’t have to be complicated. With the right information, preparation, and comparison, you can secure the best loan deal for your needs. Whether you’re planning a dream vacation, starting a new business, or purchasing a new car, the options are plenty — and so are the lenders.

Make sure to compare terms, read the fine print, and choose a trusted bank like Wells Fargo, Bank of America, Chase, Citibank, or Discover for a hassle-free experience.